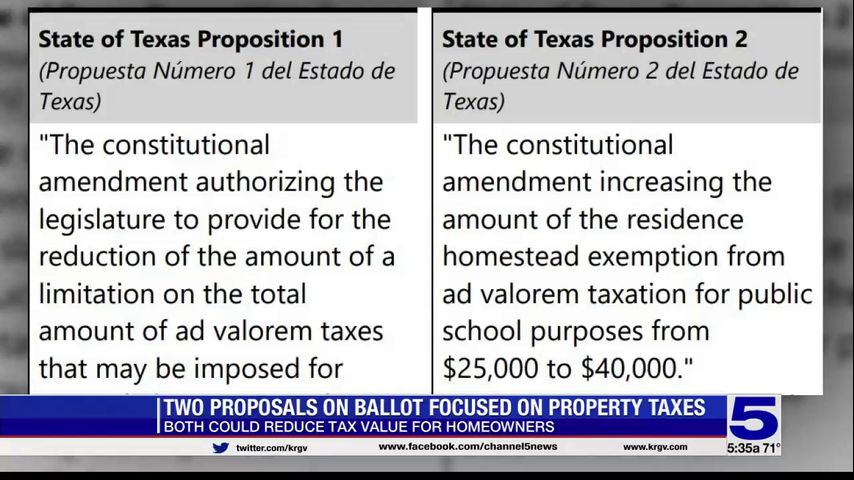

Two propositions on ballot focus on property taxes

Early voting is now underway and runs until May 3, with Election Day set for Saturday, May 7.

Outside of mayoral and school board races, voters will also find two state constitutional amendments that could reduce how much voters pay in taxes.

RELATED: Valley-wide early voting underway

Both proposed amendments to the state constitution are focused on property taxes.

According to the ballot, if Proposition 2 is approved, the amendment would increase the amount of the state’s existing homestead exemption from $25,000 to $40,000.

“So, whatever value you have on your house, once you apply for it, of course, and you qualify for it, then it would reduce the taxable value for the school district by 25,000,” said Hidalgo County Assistant Chief Appraiser Jorge Gonzalez. “On your ballot, you’re seeing that it might go up to $40,000, if it’s passed by the taxpayers.”

Gonzalez breaks down how public schools would tax qualified homestead exemption residents.

“In our county, I believe our typical rate for school districts ranges between 1.15 to 1.25 cents per $100 evaluation,” Gonzalez said. “So, whatever the net is left, they are going to go ahead and tabulate that net value times their rate.”

One report says if voters approve Proposal 2, it would save qualifying homeowners about $176 on their property tax bill on average.

If approved by voters, Proposal 1 would decrease the tax dollar amount that elementary and secondary schools may impose on qualified homestead owners who are elderly and disabled.

“We’re pretty sure the taxpayers are going to pass favorably on both constitutional amendments,” Gonzalez said.

If voters pass the amendments, they would go into effect on January 1 of next year.