Texas collects 5th highest percentage of property tax revenue in US, report finds

If you own property, chances are you saw your tax bills climb this year.

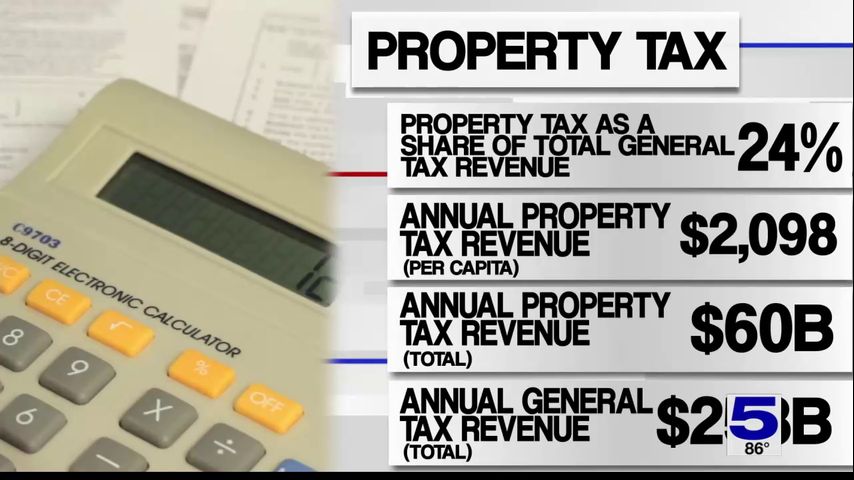

A new report from porch.com ranks Texas fifth in the amount of property taxes collected compared to total tax revenues.

Using data from the Institute on Taxation and Economic Policy that include property, income, and sales tax numbers, lower-income Texans pay way more in taxes than not just Californians in the same tax bracket, but more than the top 20 percent of earners in the state.

For context, if a person makes $22,000 a year in Texas, even though there's no income tax, they will still pay nearly three percent more than their Californian counterpart.

To contrast those numbers, if a person made over $666,000 in Texas, they’d only pay three percent. In California, that jumps to 12 percent as a top earner.

Even though Texans have zero income taxes, property taxes more than make up for it so the state can generate revenue.

Click here to view the report.