Pharr Family Pharmacy owner, six others indicted in $110 million health care fraud scheme

A compound pharmacy owner, three marketers, a referring physician and two clinic office staff members were charged for their alleged role in a multimillion-dollar health care fraud and kickback scheme Friday.

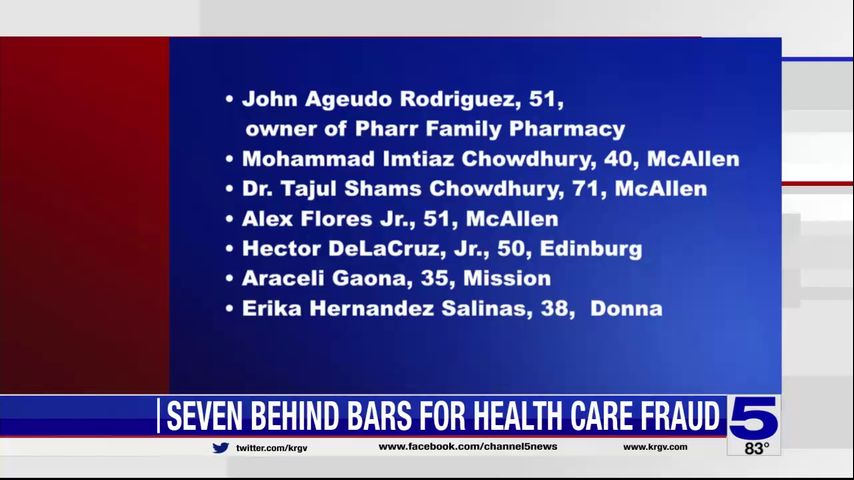

Among those charged was John Ageudo Rodriguez, 51, owner of Pharr Family Pharmacy; Mohammad Imtiaz Chowdhury, 40, his father - Dr. Tajul Shams Chowdhury, 71, - and Alex Flores Jr., 51, all of McAllen; Hector DeLaCruz, Jr., 50, of Edinburg; Araceli Gaona, 35, of Mission; and Erika Hernandez Salinas, 38, of Donna, were also charged in the indictment.

The indictment alleges that from May 2014 through September 2016, PFP billed various federal health care programs more than $110 million, including claims that were false, fraudulent and the result of illegal kickbacks. According to a news release from the U.S. Attorney General’s Office, the targeted programs included the Federal Employee’s Compensation Program, TRICARE, Medicare and various private insurance plan that were known to pay high reimbursements for compound drugs.

As part of the scheme, Rodriguez allegedly provided Mohammad Chowdhury – marketers with PFP - with pre-filled prescription pads intended to be given to physicians. The charges allege these included compound drugs and other prescription items that would yield the highest possible reimbursement to PFP, the news release stated.

Among the physicians involved in the scheme was Dr. Tajul Shams Chowdhury of the Center for Pain Management in Edinburg. His son, Mohammad Chowdhury, paid him kickbacks for referring prescriptions to PFP. Center for Pain Management employees Araceli Gaona and Erika Hernandez Salinas helped coordinate the flow of prescriptions from the clinic to the pharmacy, the news release stated.

All seven individuals went before U.S. Magistrate Judge J. Scott Hacker on Friday and each were charged with health care fraud and money laundering among other charges, records show. They were all remanded to custody of the U.S. Marshals Service and had their arraignment set for Monday, June 21.

If convicted of the more serious charge of money laundering, all of them face up to 20 years in prison and a maximum fine of $500,000.